Things about Offshore Asset Management

Wiki Article

6 Easy Facts About Offshore Asset Management Explained

Table of ContentsOffshore Asset Management Fundamentals ExplainedOffshore Asset Management - The FactsLittle Known Questions About Offshore Asset Management.The smart Trick of Offshore Asset Management That Nobody is Discussing

8 billion), as well as in 2022 an overall of $8 - offshore asset management. 4 billion was elevated with IPOs, which saw demand in extra of $180 billion from neighborhood as well as global financiers. Hereof, we are all concerning remaining to improve this development and also energy and unlock the possibility of the marketplace and lead the way for economic sector IPOs.A prime example of this is DET's recent collaboration with Dubai World Profession Centre, Dubai Chamber of Digital Economic climate as well as various other stakeholders to drive worldwide passion and involvement at GITEX Global 2022 and North Star Dubai 2022. We were motivated to see our efforts happen as the tech program attracted greater than 170,000 attendees, 40 percent of whom were international, while the occasion itself generated an approximated $707 million in overall economic result.

Our technique goes much beyond advertising Dubai as well as drawing in services to set up procedures in the Emirate. It is developed to look at the complete influence advantages that the Emirate can take advantage of as a worldwide riches hub by tracking the number of firms connected to the riches administration industry, along with the variety of work, abilities as well as employees that they would offer the market.

Offshore banks will certainly keep all your monetary documents in count on due to the fact that it does not mandate you to share such info with any person else, consisting of the government. These banks will certainly use you monetary personal privacy that most local monetary banks can not pay for. One advantage of overseas financial is that it enables you to open overseas structures.

How Offshore Asset Management can Save You Time, Stress, and Money.

Offshore financial investment monitoring refers to taking advantage of in investment possibilities and also approaches offered outside of a financier's residence country. There are numerous financial investment opportunities that are given by offshore investment financial institutions. The key role of the bank is to take care of the possessions of the investors. People with considerable amounts of money accrue significant benefits when they spend in overseas wealth management firms.

Below are a few of the benefits of overseas property management that financiers ought to understand. There are countless offshore counts on property protection that are specifically associated with business of securing properties. If a private suspects that their money is at risk, they can rapidly transfer a portion of their wide range or possessions to an offshore business for protection purposes.

Most of the funds transferred a fantastic read to an offshore account for defense are not kept in safes or by banks. The riches can be dispersed among numerous business or invested for economic gain by the overseas wide range security company. Most of the overseas wealth monitoring firms are called for to send income tax obligation on the wealth created via overseas assets.

Offshore territories supply the benefit of privacy regulations. Most of the countries that are extended for overseas banking have currently executed regulations establishing high criteria of banking confidentiality.

The 30-Second Trick For Offshore Asset Management

In the case of cash laundering or medicine trafficking, overseas legislations will certainly allow identification disclosure. Overseas accounts to not have any type of restrictions.

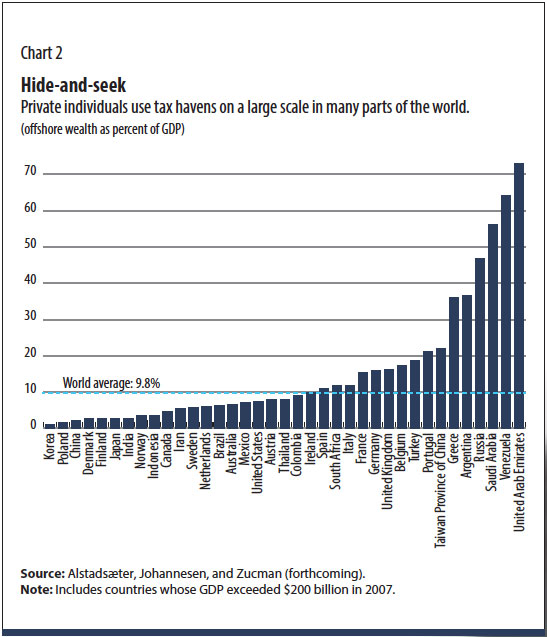

In such circumstances, many of the capitalists gain access to considerable tax incentives that one can not obtain in industrialized nations such as the USA. Offshore company tax advantages are several of the factors as to why a significant variety of possession holders have actually moved their properties to overseas wealth monitoring entities - offshore asset management.

Tax rewards are introduced as one method of encouraging foreigners to invest and thereby enhance economic tasks. Purchasing overseas riches management is an eye-catching chance to fulfill the needs of the wealthiest of capitalists. If you agree to spend your properties in an offshore account, you can gain from a wider series of financial investments, possession defense, and tax obligation advantages.

The Of Offshore Asset Management

Firms have actually typically stuck to offshoring small non-core business jobs to service companies in various other nations. However, current technological innovations have set off the fad of offshoring vital business procedures. Offshore money is one such organization task! Offshore money can Learn More Here aid companies offshore crucial monetary jobs, such as complicated money testimonials, tax obligation prep work, regulatory compliance, etc.That does not have to include you! In this post, we'll answer 12 of the most regularly asked concerns about offshore money. At the end of this read, you would certainly be able to understand key ideas, such as tax obligation havens, offshore accounts, tax obligation evasion, as well as extra.

Offshore money is when a business especially offshores financial services to an internal team or third-party suppliers overseas. These solutions include tax obligation governing conformity, wide range management, economic evaluations, etc. Business might offshore fund to an overseas country for numerous reasons, consisting of: Property protection and security. Better tax programs. Secure economic problems.

Keep in mind that firms can offshore fund either via an outsourcing arrangement with a third-party company or by establishing their internal group overseas. This is a little various from outsourcing, where firms can just outsource their company functions to third-party solution providers no matter their location. Right here's a better consider the 3 vital kinds of overseas money services: Offshore finance services refer to outsourcing monetary company tasks overseas.

Report this wiki page